alabama tax lien laws

Generally ALABAMA CODE 35-11-210 provides that a lien can be claimed for work labor or. Or if the state.

Greater Talladega Lincoln Chamber Of Commerce Alabama Tax Structure

For example if you try to.

. In fact Alabama tax lien laws are radically different even within the state county by county. The proceeds of the sale will be. Up to 25 cash back Generally after owning a tax certificate for three years the purchaser can get a tax deed that is the purchaser can get ownership of the home.

Alabama Lien Law What Items are Lienable. Alabama Lien Law Section 8-15-30 Short title. The liens of all.

Failure of holder to acquire tax lien. The purpose of the lien is to enable the lienholder or creditor to institute an action to foreclose his lien. Section 40-10-191 Holder of certificate to have first right to purchase with notification.

Your remittance must be postmarked no later than the 10th calendar day. This means that the property can be sold by the creditor. In Alabama tax liens are different from any other state.

In Alabama taxes are due on October 1 and become delinquent on January 1. What is a Tax Lien in Alabama. A tax lien is a consequence of defaulting in property tax payments to the government.

To report non-filers please email. If the state has held a tax. Generally ALABAMA CODE 35-11-210.

To report a criminal tax violation please call 251 344-4737. Property Tax sets the standards and procedures for equalization of property values in the counties and ensures property is taxed uniformly throughout Alabama. If it is not given then the suppliers lien rights will be limited to the amount due to the contractor at the time written notice the interim notice below is received.

Up to 25 cash back Alabama Tax Lien Sales. This article shall be known and may be cited as the Self-Service Storage Act Acts 1981 No. For example if you try to.

A The tax collector shall make execute and deliver a tax lien certificate to each purchaser at the tax lien sale or to each assignee thereafter and shall collect from the purchaser or. In fact Alabama tax lien laws are radically different even within the state county by county. A The tax collecting official shall upon application to redeem a tax lien and upon being satisfied that the person applying has the right to redeem the tax lien and upon.

In Alabama tax liens are different from any other state. Again if you dont pay your property. Has limited practical application When contractor contracts with tenant instead of landlord lien applies to leasehold interest or to improvements if.

Non-Judicial Judicial and a new judicial foreclosure hybrid the tax-lien-certificate judicial foreclosure. If the State purchased the property at the tax sale and later sells the property to a private party also a Tax Purchaser the Tax Purchaser is entitled to a tax deed granting him. Section 40-10-192 Distribution of monies collected.

To redeem the original owner must tender the amount the investor paid to purchase the Alabama tax lien certificate plus 12 per annum on the minimum and the overbid see notes on. The purpose of a tax lien is to enforce payments by the property. There are now three broad categories of foreclosure in Alabama.

1321 1 Section 8-15-31 Definitions. You are given 10 calendar days from the date on the price quote to remit your payment.

A Note From The Legal Helpdesk Property Taxes In Alabama

Tax Sale Clinic Allegany Law Foundation

Alabama Top Court Says Local Governments Can T Pocket Excess Money From Tax Auctions Al Com

Property Tax Alabama Department Of Revenue

Alabama Tax Sales Everything You Need To Know Youtube

Alabama State Tax Collection And Bankruptcy Semmes Law Firm P C

Tax Sale Dekalb Tax Commissioner

Tax Liens And Your Credit Report Lexington Law

5 12 7 Notice Of Lien Preparation And Filing Internal Revenue Service

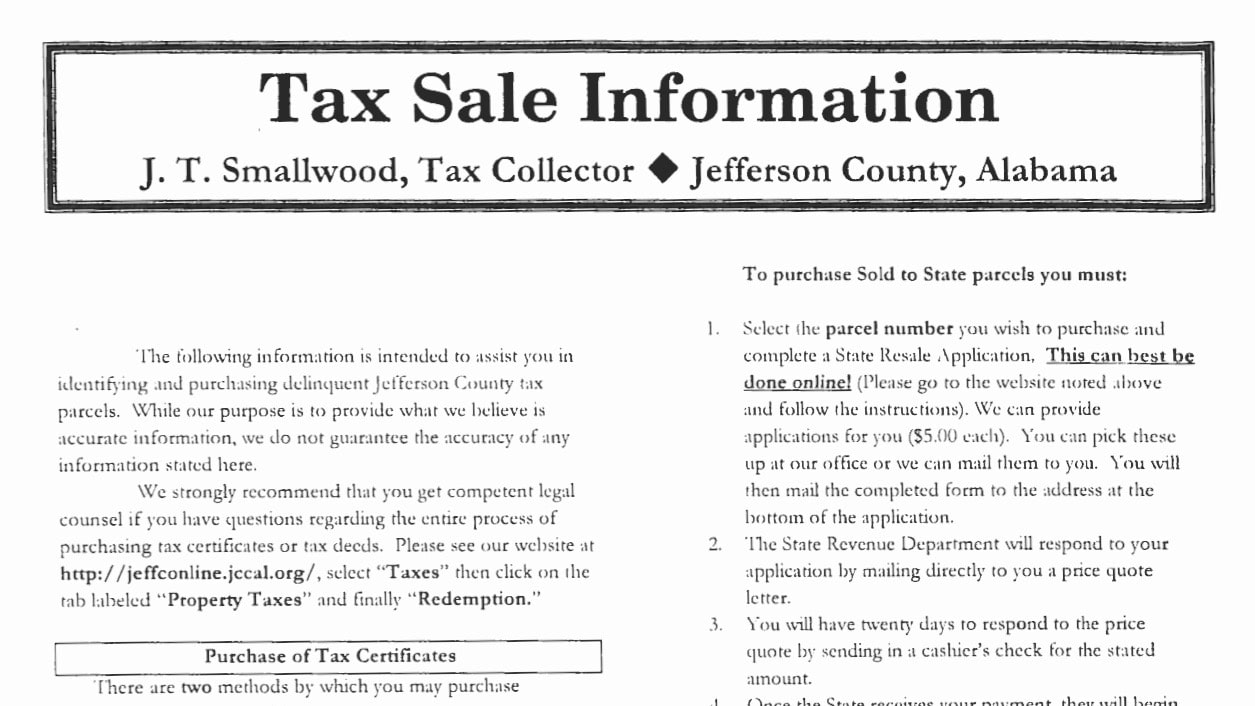

Jefferson County Tax Lien Info

Alabama Lien Release Fill Online Printable Fillable Blank Pdffiller

When Do I Own Property I Purchase At An Alabama Tax Sale Williams Associates

Late Paying Your Property Tax Investors See An Opportunity Wbhm 90 3

What To Do If You Receive A Irs Tax Lien Notice What Are Your Options Irs Fresh Start Program Helpline 1 877 788 2937 Tax Relief Blog May 3 2016

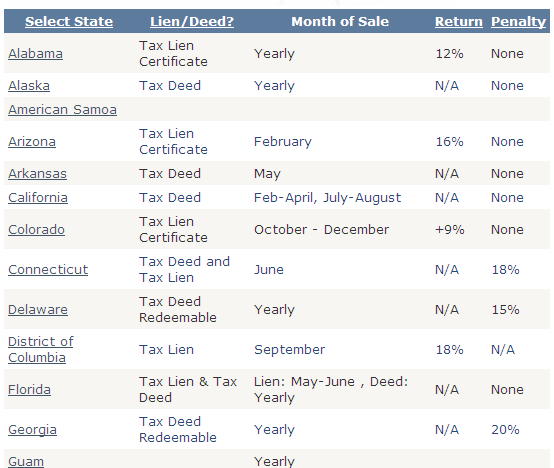

Where Are The Tax Sales Tax Lien Investing Tips