irrevocable trust capital gains tax rate 2020

Capital gains taxes are usually lower than earned income taxes. For example the top federal income tax rate is 37 and the top capital gains tax rate is 20.

How To Avoid Estate Taxes With A Trust

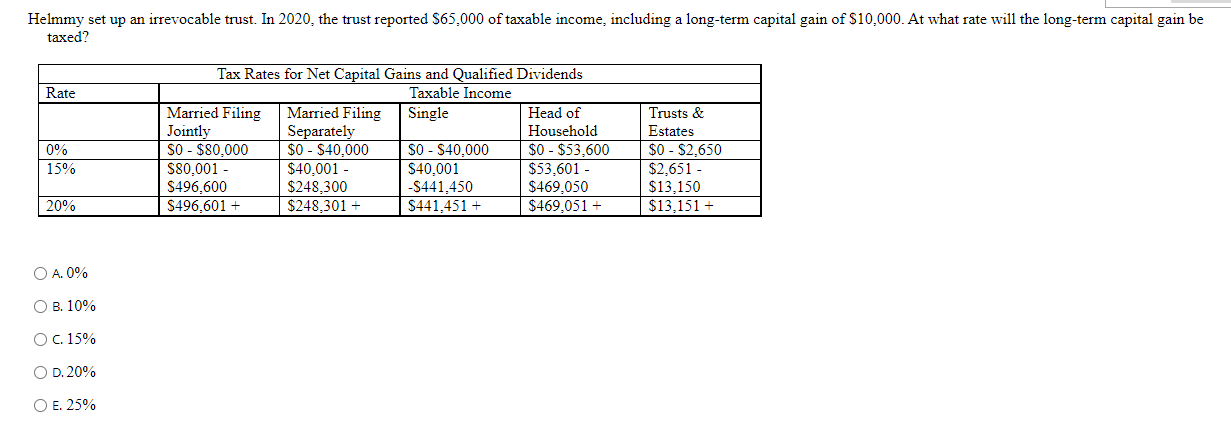

What is the capital gains tax rate for trusts in 2020.

. So for example if a trust earns 10000 in income during 2022 it would pay the following taxes. The maximum tax rate for long-term capital gains and qualified dividends is 20. They would apply to the tax return.

What is the capital gains tax rate for trusts in 2020. The maximum tax rate for long-term capital gains and qualified dividends is 20. For tax year 2020 the 20 rate applies to.

The trustee of an irrevocable trust has discretion to distribute income including capital gains. The trust has the following 2020 sources of income and deduction. For tax year 2020 the 20 rate applies to.

Whether or not capital gains taxes are due after the sale of a trust asset will depend on several factors starting with the type of. A CRT is an irrevocable tax-exempt trust in. 115-97 made major changes to the taxation of corporate.

Trust tax rates are very high as you can see here. Trust Tax Rates. It continues to be important.

For tax year 2022 the 20 rate applies to amounts above. The maximum tax rate for long-term capital gains and qualified dividends is 20. Capital gains and qualified dividends.

What is the capital gains tax rate for trusts in 2020. For example the top federal income tax rate is 37 and the top capital gains tax rate is 20. For example the top ordinary.

Irrevocable Trusts and Capital Gains Taxes. The maximum tax rate for long-term capital gains and qualified dividends is 20. You can find your adjusted gross income on line 11 of the 2020 Form 1040.

10 of 2750 all earnings between 0 2750 275. 24 of 7099 all. Sunday June 12 2022.

For tax year 2020 the 20 rate applies to amounts above 13150. For tax year 2020 the 20 rate applies to. Trusts and estates pay capital gains taxes at a rate of 15 for gains between 2600 and 13150 and.

The maximum tax rate for long-term capital gains and qualified dividends is 20. For tax year 2020 the 20 rate applies to. Capital gains and qualified dividends.

9 How is irrevocable trust income taxed. Below are the tax rates and income brackets that would apply to estates and trusts that were opened for deaths that occurred in 2021. What is the capital gains tax rate for trusts in 2020.

Here are the rates and thresholds for 2020. Capital gains taxes are usually lower than earned income taxes. Report the applicable amounts calculated on this form on line 13200 or line 15300 of Schedule 3 Capital.

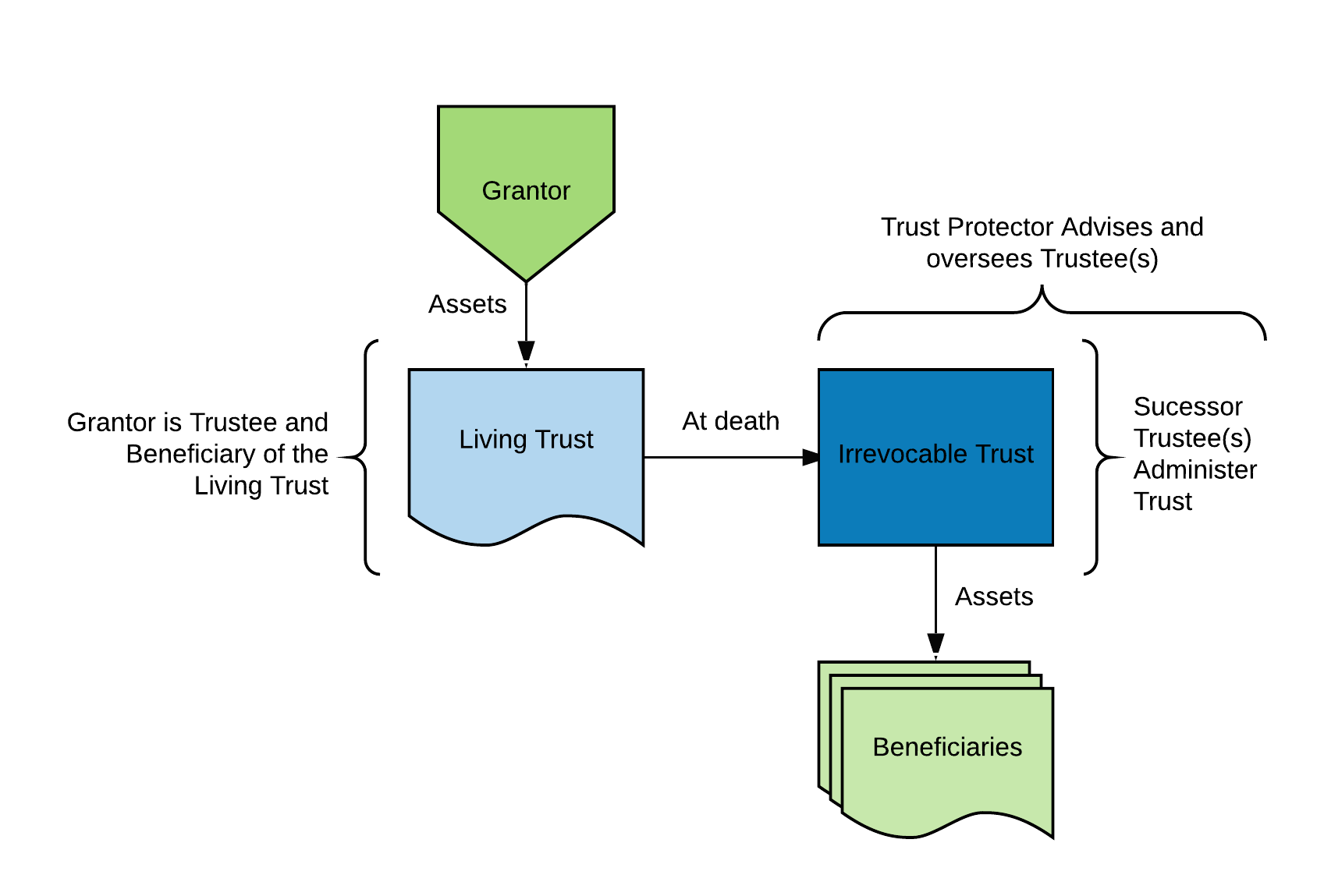

Trust tax rates follow similar rates to those paid by individuals but reach those rates at much lower thresholds. An irrevocable trust needs to get a tax ID EIN number and pay taxes each year by filing a 1041 tax return. Irrevocable trust capital gains tax rate 2020.

The maximum tax rate for long-term capital gains and qualified dividends is 20. Trusts and estates pay capital gains taxes at a rate of 15 for gains between 2600 and 13150 and 20 on capital gains above 1315000.

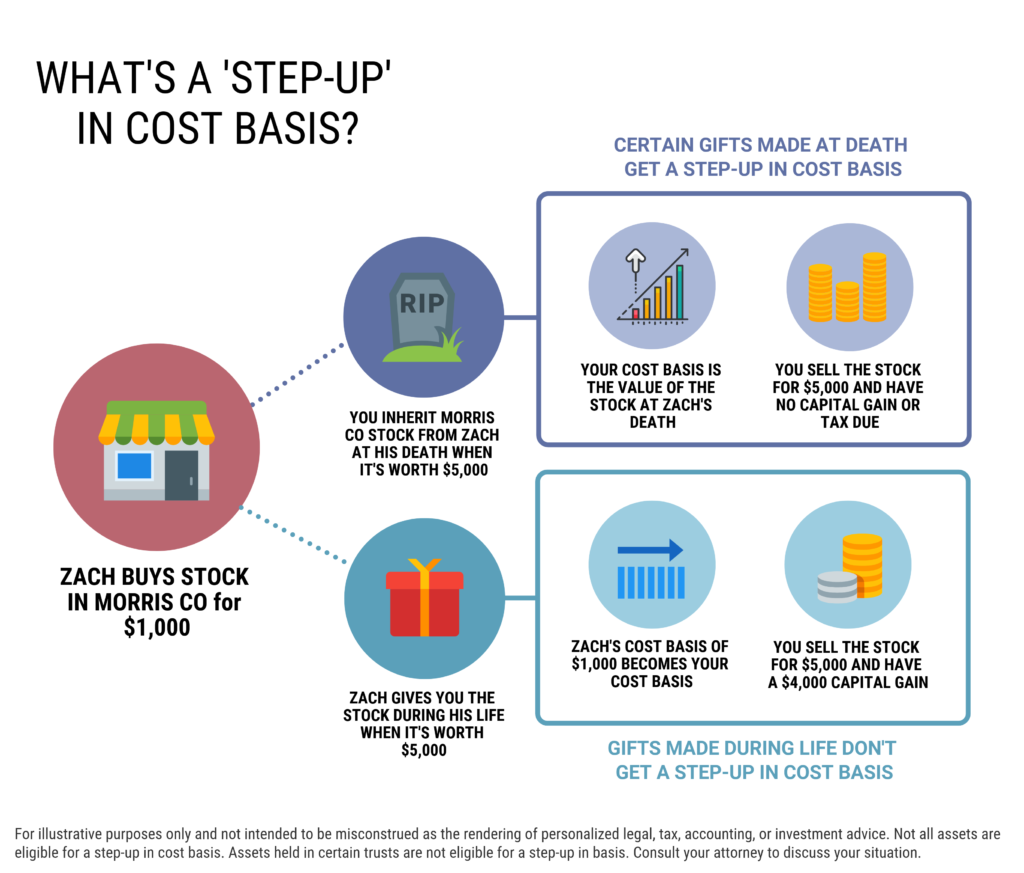

What Is A Step Up In Basis Cost Basis Of Inherited Assets

Definitive Guide On Irrevocable Life Insurance Trusts

A Guide To Wiser Giving Wintrust Wealth Management

Incomplete And Completed Gift Non Grantor Trusts

Do Irrevocable Trusts Pay The Capital Gains Tax

Revocable Vs Irrevocable Trusts Smartasset

How To Save Estate Gift Taxes With Grantor Trusts The Basics Johnson Pope Bokor Ruppel Burns Llp

How A Grantor Trust Works Smartasset

Impact Of Biden Grantor Trust Changes On Grat Idgt Slat

3 11 14 Income Tax Returns For Estates And Trusts Forms 1041 1041 Qft And 1041 N Internal Revenue Service

Solved Helmmy Set Up An Irrevocable Trust In 2020 The Chegg Com

5 Ways To Modify An Irrevocable Trust Wealth Management

Irrevocable Trust Callahan Financial Planning

Estate Planning San Francisco Bay Area Trust Probate And Conservatorship Litigation Lawyer Blog Talbot Law Group P C

Generation Skipping Trust Gst What It Is And How It Works

Proposed Impactful Tax Law Changes And What You Can Do Now Johnson Pope Bokor Ruppel Burns Llp